The amount you owe depends on your earnings, tax filing standing and how much time you owned the property. A 1031 Trade allows proprietors defer spending this tax, which allows Enhance their base strains.

Understood doesn't offer tax or legal suggestions. This product isn't a substitute for searching for the recommendation of a certified Expert in your person problem.

A 1031 Trade enables investors to defer capital gains tax to the sale of one financial commitment residence by reinvesting the proceeds into One more like-sort residence.

“This includes determining the relinquished assets, that means the a single that you are advertising, and also the substitution residence – the one you are getting,” claims Katz.

It’s imperative that you total the form effectively and with out error. In the event the IRS believes you haven’t performed by The principles, you may be hit using a major tax bill and penalties.

The payment we get from advertisers does not affect the suggestions or tips our editorial staff provides inside our posts or otherwise influence any in the editorial articles on Forbes Advisor. Even though we work hard to offer precise and updated data that we predict you'll find pertinent, Forbes Advisor will not and cannot warranty that any information and facts delivered is entire and can make no representations or warranties in connection thereto, nor on the accuracy or applicability thereof. Here's a summary of our partners who give products which We have now affiliate one-way links for.

The investor decides to utilize the 1031 exchange. They provide the apartment building and make use of the proceeds to obtain the retail House in Boston. By utilizing read more the 1031 Trade, they might defer paying capital gains tax around the sale in the apartment constructing.

Examine much more homeownership resourcesManaging a mortgageRefinancing and equityHome improvementHome valueHome insurance plan

David has aided 1000s of shoppers make improvements to their accounting and financial techniques, make budgets, and minimize their taxes.

By deferring funds gains and depreciation recapture taxes, she's efficiently remaining with extra money to invest in the new assets.

1031 exchanges utilize to real property held for financial commitment applications. Consequently, a daily family vacation property gained’t qualify for 1031 treatment Except if it can be rented out and generates an income.

Speedy funding: Bridge loans can fund swiftly, normally inside a week or much less. This gives you access to money any time you need it through the restricted 1031 timelines.

Card suggestion quizTravel benefits and perksEarn cash backPay down debtMake an enormous purchaseGet your approval odds

Higher or equivalent benefit. To fully stay clear of having to pay any tax, the net marketplace price and fairness in the residence obtained should be similar to, or bigger than, the home marketed.

Devin Ratray Then & Now!

Devin Ratray Then & Now! Jenna Jameson Then & Now!

Jenna Jameson Then & Now! Jurnee Smollett Then & Now!

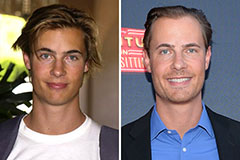

Jurnee Smollett Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!